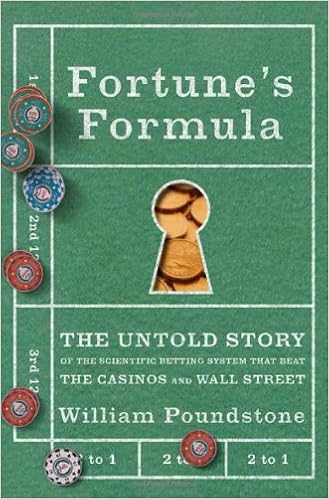

Fortune's Formula: The Untold Story Of The Scientific Betting System That Beat The Casinos And Wall Street Download Free (EPUB, PDF)

In 1956 two Bell Labs scientists discovered the scientific formula for getting rich. One was mathematician Claude Shannon, neurotic father of our digital age, whose genius is ranked with Einstein's. The other was John L. Kelly Jr., a Texas-born, gun-toting physicist. Together they applied the science of information theory―the basis of computers and the Internet―to the problem of making as much money as possible, as fast as possible.Shannon and MIT mathematician Edward O. Thorp took the "Kelly formula" to Las Vegas. It worked. They realized that there was even more money to be made in the stock market. Thorp used the Kelly system with his phenomenonally successful hedge fund, Princeton-Newport Partners. Shannon became a successful investor, too, topping even Warren Buffett's rate of return. Fortune's Formula traces how the Kelly formula sparked controversy even as it made fortunes at racetracks, casinos, and trading desks. It reveals the dark side of this alluring scheme, which is founded on exploiting an insider's edge.Shannon believed it was possible for a smart investor to beat the market―and Fortune's Formula will convince you that he was right.

Paperback: 386 pages

Publisher: Hill and Wang; 1st edition (September 19, 2006)

Language: English

ISBN-10: 0809045990

ISBN-13: 978-0809045990

Product Dimensions: 5.5 x 1.1 x 8.2 inches

Shipping Weight: 13.4 ounces (View shipping rates and policies)

Average Customer Review: 4.3 out of 5 stars See all reviews (140 customer reviews)

Best Sellers Rank: #35,751 in Books (See Top 100 in Books) #18 in Books > Humor & Entertainment > Puzzles & Games > Gambling #61 in Books > Business & Money > Investing > Stocks #1309 in Books > History > Americas > United States

This is an excellent book about the discovery of the Kelly formula that is unknown outside gambling. This story has three protagonists. Two of them were scientists working at Bell Labs: Claude Shannon, a genius polymath who developed information theory; and John Kelly, a maverick genius, who is directly responsible for the development of Kelly's formula. The third one is a brilliant MIT mathematician, Ed Thorp.Ed Thorp tested the Kelly formula in both gambling and investing. Also, he came up with an options formula before Fischer Black and Myron Scholes. His formula missed a risk-free rate component due to the structure of the market at the time. As a result, Ed Thorp remained in obscurity while Black and Scholes became famous.Ed Thorp succeeded in deriving superior returns in both gambling and investing. But, it was not so much because of Kelly's formula. He developed other tools to achieve superior returns. In gambling, Ed Thorp succeeded at Black Jack by developing the card counting method. He just used intuitively Kelly's formula to increase his bets whenever the odds were in his favor. Later, he ran a hedge fund for 20 years until the late 80s and earned a rate of return of 14% handily beating the market's 8% during the period. Also, his hedge fund hardly lost any value on black Monday in October 1987, when the market crashed by 22%. The volatility of his returns was far lower than the market. He did this by exploiting market inefficiencies using warrants, options, and convertible bonds. The Kelly formula was for him a risk management discipline and not a direct source of excess return.Ed Thorp's career as a hedge fund manager was temporarily cut short.

"Fortune's Formula" tells the story of the Kelly Criterion -through the experiments, ideas, wins, and losses of those who have espoused it and who have derided it, at race tracks, black jack tables, sports books, and, finally, on Wall Street. The Kelly Criterion is a risk management formula published in 1956 by Bell Labs information theorist John Kelly, Jr. that dictates how much of your bankroll you should bet based on your edge divided by the odds so that you will have zero risk of ruin no matter how bad your luck is, while increasing wealth faster than any other betting system. It does not address what bets you should make, which is another matter entirely. Instead of writing a simple analysis of the Kelly Criterion, author William Poundstone brings this story alive by relating the histories of key figures who have used, promoted, or criticized the Kelly Criterion: information theorists, economists, traders, gamblers, and gangsters. Some readers may find this approach unfocused and unnecessary. But I think the personalities lend "Fortune's Formula" an epic quality and place the Kelly Criterion firmly in the context of real life, with real consequences, as opposed to the realm of abstruse theories that never leave the halls of academe.The men whom "Fortune's Formula" casts as protagonists are Claude Shannon, the MIT scholar who invented information science and who amassed a small fortune as a buy-and-hold investor, typically making 28% per year on a small portfolio, and Ed Thorpe, author of 1962's gambling classic "Beat the Dealer", 1967's "Beat the Market", co-founder of Princeton-Newport Partners fund (1969-1988) and founder of Ridgeline Partners (1994-2002) quant fund.

I found this to be a very exciting and informative book. Once I started, I was hooked: I couldn't put it down because I wanted to learn more -- not just about the formula but all the intellectual controversy surrounding it and the cast of characters involved. This book tells the story of the 'Kelly criterion' and how certain people used it to beat the casinos and earn consistently above-average returns in the stock market. The cast of characters extend from famous organized crime figures (Bugsy, Longy Zwillman, etc.) to Claude Shannon, father of information theory, to Milken, the junk bond king, and many more.You can view this book as a study on the history of an idea, as a study of the financial markets, or as a social study of gambling and investing. There are many faces to it. I wouldn't say it is a book on finance, or a book on history, but a bit of everyhting really. It definitely is not a book on 'how to beat the market', don't look for that here. The book does give a good explanation of the Kelly formula, in my opinion, but the whole controversy surrounding it, as well as the story of Ed Thorpe, was much more interesting for me.If you are interested in finance or financial history, math, or gambling, or how ideas evolve and why certain ideas are better known than others, you should read this book. I think that mathematically sophisticated readers can be a bit disappointed because there is no rigorous treatment of Kelly criterion. But the basic ideas of CAPM, efficient markets hypothesis, the essence of Kelly formula, and random walk, are explained quite succintly and clearly, in my opinion.The only problem I had with the book was that the author went off in tangents quite a bit, which sometimes distracted from the main story.

Fortune's Formula: The Untold Story of the Scientific Betting System That Beat the Casinos and Wall Street Beat Binary Options: Winning Financial Betting Strategies for Today's Markets Bull by the Horns: Fighting to Save Main Street from Wall Street and Wall Street from Itself I'd Rather We Got Casinos The Predictors: How a Band of Maverick Physicists Used Chaos Theory to Trade Their Way to a Fortune on Wall Street Trillion Dollar Baby: How Norway Beat the Oil Giants and Won a Lasting Fortune The Wall Street Journal Guide to Understanding Money and Investing, Third Edition (Wall Street Journal Guide to Understanding Money & Investing) The Wall Street Journal Complete Money and Investing Guidebook (The Wall Street Journal Guidebooks) Terror on Wall Street, a Financial Metafiction Novel (Wall Street Series Book 1) The WSJ Guide to the 50 Economic Indicators That Really Matter: From Big Macs to "Zombie Banks," the Indicators Smart Investors Watch to Beat the Market (Wall Street Journal Guides) Postcards from the Underground: Portraits of the Beat Era (Portraits of the Beat Generation) Betting Booze and Brothels Betting the Company: Complex Negotiation Strategies for Law and Business How to Make Money in Sports Betting: Quick Start Guide: How to eBooks, Book 19 Diversity and the Tropical Rain Forest: A Scientific American Library Book (Scientific American Library Series) Too Big to Fail: The Inside Story of How Wall Street and Washington Fought to Save the Financial System---and Themselves Heard on the Street: Quantitative Questions from Wall Street Job Interviews Private Equity at Work: When Wall Street Manages Main Street We Beat the Street: How a Friendship Pact Led to Success Unix System V/386 Release 3.2: System Administrator's Guide (AT&T UNIX system V/386 library)